Products

Citizen Savings Growth Plan

Citizen Saving Growth Plan is a Universal Life Insurance Plan that provides an opportunity of saving and accumulating funds for the future. Additionally, it offers life cover for the policyholder, thus securing the financial future of the family. It is a type of permanent life insurance that has an account value element and offers lifetime coverage as long as you pay your premiums. Saving plans are the preferred financial planning option for individuals who want the additional savings and future-centered benefits the plans provide.

Features:

| Description | Minimum | Maximum |

| Entry Age | 18 years | 55 years |

| Policy Term | 10 years | 20 years |

| Premium | Regular Pay: NRs. 12,000

Single Pay: NRs. 30,000 |

As per underwriting guidelines of company and based on income of life assured. |

| Sum Assured | Regular Pay: NRs. 120,000

Single Pay: NRs. 37,500 |

As per underwriting guidelines of company and based on income of life assured. |

| Premium Paying Term | Single or same as policy term | |

| Maturity Age | 70 years | |

| Mode of Premium Payment | Single, Yearly, Half Quarterly, Quarterly | |

Benefits Payable Conditions:

- If the assured is alive till the end of the policy term, the Account Value on the maturity date will be payable subject to the terms and conditions under the policy.

- If the assured dies before the maturity of the policy, Sum Assured or Account Value on the date of death whichever is higher will be paid subject to the terms and conditions under the policy.

- Life Assured will be eligible for a loyalty reward at the end of the policy term. A guaranteed 3% of Account Value will be added to the Average Account Value of the last 60 months at maturity subject to the regular payment of all the due premium installments regularly as on maturity. This loyalty reward gets credited to the Account Value at the maturity of the policy and is paid to assure as the maturity value upon the survival of life assured at maturity of the policy.

The insurer shall deduct policy loan including accrued interest, if any, and indebtedness (if any) from Claim amount under this policy.

To whom Payable:

Life Assured if alive or the nominee of the life assured or legal heirs of assured under Section 127 (2) of the Insurance Act, 2079 if the nominee is not alive will be the beneficiary under this policy. If any other person or institution proves legal title of the policy, then s/he shall be the beneficiary of this policy up to his/her receivable amount but not exceeding the benefit payable under this policy.

Premium Payment:

- Under single premium payment policy, all the premiums of policy term would be payable at the date of commencement of policy.

- Under all the policies other than single premium, the following shall be applicable:

- Premium would be payable yearly/ half-yearly/ quarterly/ monthly.

- The first payment is due on the date of commencement of the policy.

- Renewal premiums are due on the renewal premium due dates.

- The last payment is due on the date of termination of premiums or on the premium due date just before the date of death of the life assured whichever occurs first.

Payment of Premium

- The risk coverage will continue by deducting the cost of insurance from Account Value every month. The deduction of cost of insurance will diminish the amount of account value. If the account value doesn’t meet the requisite cost of insurance, the policy will automatically cease.

- In case of non-payment of renewal premium during the policy term, the assured should pay all the due premiums in lump sum. Accordingly, such premium will attract investment earnings (interest) from the date of payment of renewal premium. A late fee will not be applicable.

- In the case of half yearly, quarterly, and monthly mode of payment, in the event of death of insured before payment of full premium for the year, the remaining premium amount for that year will not be deducted from the benefit payable.

Policy Loan

A loan may be obtained at any time from the Company on a policy that has a surrender value, subject to satisfactory proof of legal ownership of the policy. The maximum amount of the loan will be 90% of the surrender value and minimum of Rs. 1,000. A loan may be repaid at any time without notice.

Interest, at a rate determined by the Company, will be charged on any loan made under this section.

If at any time the surrender value is less than the amount of the loan and any unpaid interest, the policy will be terminated and recover the loan and interest due.

Surrender Value

For the policy with yearly, half-yearly, quarterly, and monthly mode of payment, on payment of premium for 3 full years and after completion of 3 policy anniversaries, the surrender value shall become admissible; and for the single premium policy after completion of 3 policy anniversaries, the surrender value shall become admissible.

Accidental Death/ Permanent Total Disability/ Permanent Partial Disability

The insurer agrees to pay the following Benefits for losses occurring on or after the Policy Date and during the period this section is in effect subject to the Terms, Conditions and Exceptions applicable to this Section.

- Accidental Death Benefit (ADB)

When injury results in loss of life of an insured within one hundred eighty-three (183) days from the date of the accident, the insurer will pay the lump sum of ADB Sum Assured, and Sum Assured or Account Value on date of death whichever is higher. - Permanent Total Disability (PTD)

When, as the result of injury and commencing within three hundred and sixty-five (365) days from the date of accident, the insured is Totally and Permanently Disabled or has suffered from below mentioned losses the insurer shall pay the PTD Sum Assured, and Account value on date of accident. Thereafter, the policy shall cease risk coverage.

In cases where the permanence of total disability is uncertain; such disability must continue for a period of three sixty-five (365) days from a date of accident and must be total, continuous, and permanent at the end of this period.Total loss of sight of both eyes. Sum Assured Loss of both hands from or above the wrist. Sum Assured Loss of both feet from or above the ankle. Sum Assured Loss of one hand from or above the wrist and loss of one foot from or above the ankle. Sum Assured Loss of one hand from or above the wrist and sight of one eye. Sum Assured Loss of one foot from or above the ankle and sight of one eye. Sum Assured In case of occurrence of more than one of the losses specified under the Permanent Total Disability, the total indemnity payable hereunder is established by adding the indemnity corresponding to each single loss up to a maximum limit of Sum Assured.

- Permanent Partial Disability (PPD):

When, as the result of injury and commencing within the 120 days from the date of accident, the insured is Partially and Permanently Disabled the insurer will pay for the below – mentioned losses.PPD Schedule of Benefits:

S. No.

Definition of Disability % of Sum Assured 1. Loss of one eye 40% 2. Complete deafness of one ear 30% 3. Loss of one arm or one hand 50% 4. Total loss of thumb 15% 5. Total amputation of forefinger 10% 6. Amputation of four fingers including thumb 40% 7. Amputation of four fingers excluding thumb 35% 8. Amputation of the median finger 8% 9. Amputation of a finger other than thumb, forefinger and median 3% 10. Amputation of thigh (lower half) and leg 50% 11. Total loss of foot (tibio-tarsal disarticulation) 45% 12. Partial loss of foot (sub-anklebone disarticulation) 40% 13. Partial loss of foot (medio-tarsal disarticulation) 35% 14. Partial loss of foot (tarso-metatarsal disarticulation) 30% 15. Total amputation of all the toes 25% 16. Amputation of four toes including big toe 20% 17. Amputation of four toes 10% 18. Amputation of two toes 5% 19. Amputation of one toe other than big toe 3%

On the happening of PPD, the coverage for ADB and PTD will cease, and the policyholder to his/her policy by paying regular premium as applicable. The cost of insurance for basic coverage will be deducted from account value on each monthly due date, and the cost of insurance for PTD, ADB and PPD will not be deducted from account value monthly.

In case of occurrence of more than one of the losses specified under the Permanent Partial Disability, the total indemnity payable hereunder is established by adding the indemnity corresponding to each single loss up to a maximum limit of 50% of the Sum Assured.

Limitation and Exclusion:

It is hereby agreed that, notwithstanding the provisions of this Policy and Supplementary Contract made a part thereof if the insured dies directly or indirectly due to following events, the insurer’s liability under this Policy shall be limited to the Account Value on the date of death:

- Death during flying through any airline other than operated by licensed airline which travel through fixed route by paying airfare.

- Death due to War or any act of war, declared or undeclared, criminal or terrorist activities, active duty in any armed forces, direct participation in strikes, riots and civil commotion or insurrection.

- Any breach of law by the life assured or an assault or break of civilian or monetary rules and regulation.

- While sane or insane, if death by suicide within two years from policy inception date or policy revival or intentionally self – inflicted injury.

- Pre-existing Conditions.

In addition to the above, in the event of Accidental Death/ Permanent Total Disability/ Permanent Partial Disability due to following exclusion, the insurer’s liability under this Policy shall be limited to the Account Value on the date of incident:

- Participation either in professional or semi-professional sports or competition and racing of any kind, hazardous sports such as skydiving, water skiing, underwater activities requiring breathing apparatus, Pot Holding, Trekking, Paragliding, Bungee Jumping, Parachuting, and illegal activities.

- Death due to ionizing radiation or contamination by radioactivity from any nuclear fuel or nuclear waste from process of nuclear fission or from any nuclear weapons material.

Apart from the exclusion of the above risks, the policy is free from all the restrictions of foreign travel or occupation.

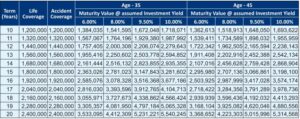

Maturity Value Illustration based on Regular Payment of Annual Premium NRs. 120,000

*Note: The details mentioned here have been kept for the purpose of informing the customer. If the details mentioned in it conflict with the terms and conditions of the insurance policy, it will be according to the insurance policy.

Issued Date: 23.06.2024

Citizen Annual Money Back Insurance Plan

A profit plan specifically designed for people who need cash in hand for their businesses, walks of....

Citizen Protection Plan

Citizen Protection Plan is a Group Insurance Plan. This plan can be issued to Micro Finance....

Citizen Group Term Insurance Plan

Citizen Group Term Insurance Plan is a one year term plan which can be renewed up to age 64 years.....

Critical Illness Rider

Times are changing and so is the lifestyle of people. With the changing lifestyle and the....

Foreign Employment Term Life Policy

This policy is compulsory for those who are going out of country for the sole purpose foreign....

Citizen Regular Pay Money Back Insurance Plan

This is anticipated endowment policy with profit plan. It has been specifically designed to pay....

Citizen Endowment Plus Insurance Plan

This profit plan is the most popular form of life assurance. It provides sum assured along with....

Citizen Jeevan Sarathi Yojana

“Citizen Jeevan Saarathi Yojana” is protection plan which is designed to provide long term....

Citizen Child Future Plan Plus

This is with-profits Endowment Assurance plan. It is introduced to support the parents to build the....